Requirements, steps, costs & benefits explained

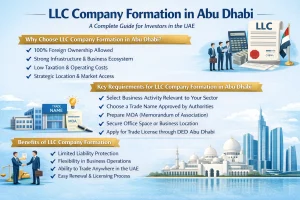

Setting up a LLC Company Formation in Abu Dhabi is one of the most popular ways for foreign and local investors to start a business in the UAE. With 100% foreign ownership, simplified regulations, and strong economic growth, Abu Dhabi offers one of the best environments in the Middle East for establishing an LLC.

This guide explains everything you need to know: structure, documents, setup process, costs, and FAQs.

What Is an LLC Company Formation in Abu Dhabi?

An LLC Company Formation is a business structure where the liability of shareholders is limited to their capital contribution. It is the most common mainland business structure in Abu Dhabi.

Key Features of an LLC:

- 2–50 shareholders allowed

- 100% foreign ownership permitted (most activities)

- Limited liability for shareholders

- Eligible for UAE residence visas

- Can do business anywhere in the UAE

- Can access government contracts and local markets

Benefits of LLC Company Formation in Abu Dhabi

1. 100% Foreign Ownership

Investors can fully own the LLC without the need for a local Emirati partner (for most business activities).

2. Operate Across the UAE

Unlike free zone entities, LLCs can trade and deliver services anywhere in the UAE.

3. Wide Range of Business Activities

LLCs can engage in:

- Trading

- Manufacturing

- Contracting

- E-commerce

- Real estate services

- Food & beverage

- Logistics

- General services

4. Eligibility for Government Projects

LLCs can bid for tenders from:

- Government entities

- Semi-government organizations

- Oil & gas sector

5. Unlimited Visa Quotas

Visa allowance depends on office space, not license type.

6. Easy Corporate Bank Account Opening

Banks prefer mainland LLC Company Formation due to transparency and operational flexibility.

7. Strong Legal Protection

Shareholders’ liability is limited to their investment.

Who Should Choose an LLC?

An LLC is ideal for:

- Trading businesses

- Construction & contracting firms

- Retail stores

- Restaurants & cafés

- Manufacturing & industrial companies

- Real estate brokerages

- Logistics & transport firms

- Local service providers requiring physical presence

For online or international-focused businesses, a free zone may also be an option—but for local UAE business, LLC is best.

Required Documents for LLC Setup in Abu Dhabi

You will need:

For Individual Shareholders

- Passport copy

- Entry stamp / visa copy

- Emirates ID (if resident)

- Passport photographs

- NOC (if on employment visa)

For Corporate Shareholders

- Certificate of incorporation

- Board resolution to form LLC

- Articles & memorandum of parent company

- Attested documents (UAE embassy & MOFA)

Company Documents

- Trade name reservation

- Initial approval certificate

- MOA (Memorandum of Association)

- AOA (Articles of Association)

- Lease contract (Tawtheeq) for office space

Step-by-Step Process for LLC Company Formation in Abu Dhabi

Step 1: Choose Business Activities

Select from 2,000+ activities listed by the Abu Dhabi Department of Economic Development (ADDED).

Step 2: Reserve a Trade Name

Submit 3–5 name options that comply with UAE naming rules.

Step 3: Obtain Initial Approval

DED reviews and approves:

- Shareholders

- Activity

- Legal structure

- Trade name

Step 4: Draft MOA & AOA

These documents outline the company’s structure, shareholding, and responsibilities.

Step 5: Secure an Office Space (Tawtheeq)

You must lease an office, warehouse, or shop depending on activity and visa requirements.

Step 6: Submit Documents & Pay Fees

Once everything is ready, submit the complete file to DED.

Step 7: Get the Trade License Issued

After approval, the LLC Company Formation License is issued.

Step 8: Apply for Visas & Establishment Card

You can apply for:

- Investor visa

- Partner visa

- Employee visas

Step 9: Open a Corporate Bank Account

Banks require:

- License copy

- MOA

- Passport copies

- Proof of address

- Business plan (in some cases)

Cost of LLC Company Formation in Abu Dhabi (2025)

Costs vary depending on activity, office size, and approvals.

Typical LLC setup cost:

AED 15,000 – AED 30,000

Additional expenses may include:

- Office rent

- Investor visa: AED 3,500–5,000

- Establishment card: AED 700–1,000

- Immigration fees

- External authority approvals

Time Required for LLC Setup

With correct documentation, LLC Company Formation formation usually takes:

⏱ 3–7 working days

Some activities requiring special approvals may take longer.

LLC vs Free Zone Company: Quick Comparison

| Feature | LLC (Mainland) | Free Zone |

| Ownership | 100% foreign | 100% foreign |

| Office Required | Yes | Flexi-desk allowed |

| UAE Market Access | Full | Limited (needs distributor) |

| Visa Quota | Unlimited | Limited to package |

| Cost | Medium | Low–medium |

| Bank Account Opening | Easy | Moderate |

| Ideal For | Local trading & services | Online & global businesses |

Frequently Asked Questions

- Can a foreigner fully own an LLC in Abu Dhabi?

Yes. Most activities now allow 100% foreign ownership.

- How many shareholders are required?

Minimum 2, maximum 50.

- Do I need a physical office?

Yes. A leased office (Tawtheeq) is mandatory.

- Can an LLC sponsor employee visas?

Yes, based on office size.

- Can I operate anywhere in the UAE?

Yes. LLCs can trade and operate across all emirates.

Conclusion

An LLC in Abu Dhabi is the best option for investors who want:

- Full access to UAE markets

- Strong legal protection

- Easy visa processing

- Ability to hire staff

- Eligibility for government tenders

With foreign ownership now permitted, forming an LLC Company Formation is simpler and more powerful than ever.