An Income Tax Scrutiny Assessment is a formal process undertaken by the Income Tax Department to verify whether the income declared, deductions claimed, and taxes paid by a taxpayer are accurate and compliant with the Income Tax Act, 1961. With increasing use of data analytics and faceless systems, scrutiny assessments have become more structured, transparent, and technology-driven.

This comprehensive content cluster explains every important aspect of Income Tax Scrutiny Assessment, including its meaning, types, notices, procedure, timelines, documents required, penalties, and how taxpayers can handle scrutiny effectively.

What Is Income Tax Scrutiny Assessment?

An Income Tax Scrutiny Assessment is conducted when the Assessing Officer (AO) selects an Income Tax Return (ITR) for detailed examination. The purpose is to ensure that the taxpayer has correctly reported income and has not claimed excessive deductions, exemptions, or losses.

The selection for scrutiny does not automatically mean wrongdoing. Many cases are selected due to automated risk parameters, high-value transactions, or mismatches in reported data.

Why Is Income Tax Scrutiny Assessment Initiated?

The Income Tax Department selects returns for Income Tax Scrutiny Assessment based on risk assessment and data analysis. Common reasons include:

- Mismatch between ITR and Form 26AS or AIS

- High-value cash deposits or property transactions

- Large capital gains or losses

- Significant refund claims

- Sudden drop or spike in income

- Non-disclosure of foreign income or assets

These triggers prompt the department to seek further clarification through scrutiny proceedings.

Types of Income Tax Scrutiny Assessment

There are different types of Income Tax Scrutiny Assessment depending on the scope of verification:

1. Limited Scrutiny Assessment

In this type, verification is restricted to specific issues such as capital gains, deductions, or cash deposits. The AO cannot go beyond the mentioned points unless approval is obtained.

2. Complete Scrutiny Assessment

A complete scrutiny allows the Assessing Officer to examine all aspects of the return, including income sources, expenses, investments, and tax payments.

3. Manual Scrutiny Assessment

Certain cases are selected manually due to sensitive issues like tax evasion, search and seizure cases, or information received from other authorities.

Income Tax Scrutiny Notices and Relevant Sections

The Income Tax Scrutiny Assessment process officially begins with the issuance of notices under the Income Tax Act:

Section 143(2) Notice

This notice informs the taxpayer that their return has been selected for scrutiny. It must be issued within a prescribed time limit.

Section 142(1) Notice

This notice seeks additional information, documents, or explanations related to the return.

Understanding the notice section is critical to responding correctly and avoiding penalties.

Income Tax Scrutiny Assessment Procedure

The step-by-step process of an Income Tax Scrutiny Assessment generally includes:

- Selection of ITR for scrutiny

- Issue of notice under Section 143(2)

- Submission of documents and explanations

- Online hearings or clarification requests

- Review by the Assessing Officer

- Passing of assessment order under Section 143(3)

Most scrutiny cases today are handled through the faceless assessment system, eliminating physical interaction.

Faceless Income Tax Scrutiny Assessment

The faceless Income Tax Scrutiny Assessment system was introduced to increase transparency and reduce corruption. Under this system:

- Cases are allocated randomly

- Communication is entirely online

- No personal meeting with the AO

- Multiple officers may review the case

This system ensures fairness and consistency in assessments.

Documents Required for Income Tax Scrutiny Assessment

Proper documentation is essential for successful completion of an Income Tax Scrutiny Assessment. Commonly required documents include:

- Bank statements

- Salary slips and Form 16

- Form 26AS, AIS, and TIS

- Investment proofs

- Capital gain computation

- Purchase and sale deeds

- Business books of accounts

- Expense bills and vouchers

Incomplete or incorrect documents may lead to adverse assessment orders.

Time Limit for Completion of Scrutiny Assessment

The Income Tax Act prescribes strict deadlines for completing an Income Tax Scrutiny Assessment. Generally, the assessment must be completed within 12 months from the end of the relevant assessment year, subject to certain exceptions and extensions.

Failure to complete the assessment within the time limit makes it invalid in law.

How to Reply to Income Tax Scrutiny Notice

Replying accurately and timely is crucial during an Income Tax Scrutiny Assessment. Taxpayers should:

- Log in to the income tax portal

- Read the notice carefully

- Upload clear and relevant documents

- Provide logical explanations

- Avoid contradictory statements

Professional assistance is recommended in complex cases to avoid legal issues.

Consequences and Penalties in Scrutiny Assessment

If discrepancies are found during an Income Tax Scrutiny Assessment, the Assessing Officer may:

- Raise additional tax demand

- Levy interest under Sections 234A, 234B, and 234C

- Impose penalties under Section 270A

- Initiate prosecution in serious cases

Timely compliance can significantly reduce exposure to penalties.

How a Chartered Accountant Can Help

Handling an Income Tax Scrutiny Assessment requires technical knowledge and legal understanding. A Chartered Accountant can:

- Analyze notices and risk areas

- Prepare accurate responses

- Represent the taxpayer before authorities

- Minimize tax liability legally

- Ensure compliance with procedural requirements

Professional support often leads to faster and smoother resolution.

Conclusion

An Income Tax Scrutiny Assessment is an important compliance mechanism that ensures transparency and accuracy in tax reporting. While receiving a scrutiny notice may seem stressful, proper understanding, documentation, and timely response can make the process manageable. With faceless assessments and digital communication, the system has become more efficient and taxpayer-friendly.

If handled correctly, an Income Tax Scrutiny Assessment can be completed without major financial or legal consequences.

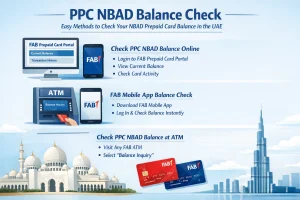

Read More – BUSINESS SET UP IN UAE